New state program gives extra cash to most vulnerable

Por Jeff Clemetson

“Good news” and “tax season” are phrases that are rarely seen together, but a new statewide program really is good news for low-income workers this tax season.

The California Earned Income Tax Credit (CalEITC) initiative is a cash-back tax credit that is new this year. The program was designed to complement the impact of the federal EITC by giving an additional check to the most vulnerable low-income workers.

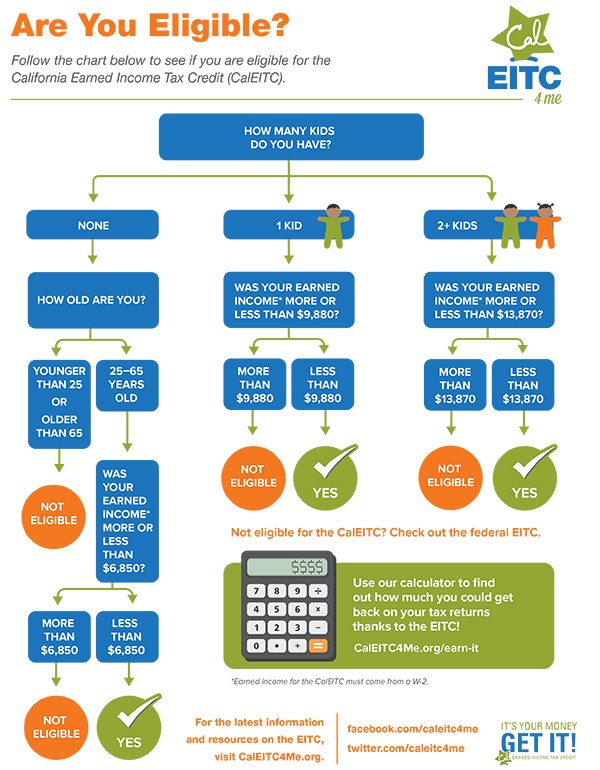

![This chart helps you determine if you qualify for the California Earned Income Tax Credit. (Courtesy of CalEITC Campaign) [Click to enlarge.]](https://sduptownnews.com/wp-content/uploads/2016/02/CalEITC_Eligibility_Infographic-ENGweb-234x300.jpg)

[Click to enlarge.]

To qualify for CalEITC funds, you must be an individual with zero dependents who earned less than $6,850 last year; or a household with one dependent who earned less than $9,880; or a household with two or more dependents who earned less than $13,870.

Also, all filers must be over the age of 25 to qualify, unless they have dependents. The maximum refund a family can receive is $2,653 but the average refund will be around $900.

Families that are eligible for CalEITC are also eligible for federal EITC benefits, which have a higher income threshold to qualify. Individuals with zero dependents that earned less than $14,820 and households with three or more children that earned less than $53,267 qualify for federal EITC money.

Many of California’s working families are eligible for both state and federal EITC benefits. However, being eligible doesn’t mean a person will automatically receive a check. Workers must file their tax returns to collect –– and that doesn’t always happen.

According to studies by the Tax Policy Center and IRS, eligible workers with no children are less likely to file for EITC money than those with children.

“This could reflect the fact that these workers are eligible for relatively small credits,” said Alissa Anderson, senior policy analyst at the California Budget & Policy Center. “Participation rates are also thought to be lower among workers who are eligible for smaller credits just in general, regardless of how many qualifying dependents they have; which again suggests that some people may not think it’s worth it to file taxes and claim the credit if they are eligible for only a small credit.”

Studies also show that people with incomes so low that they aren’t required to file a tax return also do not participate in EITC programs.

“It could be that non-filers are not aware that they can receive a refund even if they don’t owe personal income taxes or they may not think it’s worth the time and effort to file, particularly if they are eligible for only a small credit,” Anderson said.

Historically, California is ranked among the lowest in filing for the federal EITC, leaving $1.8 billion on the table that otherwise would have been available to those who need it the most. Now with nearly $400 million available through the CalEITC, an estimated $2.3 billion is available for Californians between both the state and federal programs.

A joint public and private information campaign called CalEITC4Me is underway “to keep these much-needed dollars with the people who earned them,” according to a statement released by the campaign. CalEITC4Me estimates that between the federal and state EITC refunds, it is possible for some households to receive up to $6,000 this year. To get an estimate of your potential earned credit, use the CalEITC4Me calculator at caleitc4me.com/get-it/.

“This tax season, nearly $600 million is available between the state and federal EITCs for San Diego’s working families,” Assemblymember Shirley Weber said in a statement. “That’s an estimated 50,000 filers who are eligible for CalEITC in San Diego County, benefiting up to 120,000 people.”

The majority of those who are eligible are “part-time, working single mothers,” said Holly Martinez, a spokesperson for CalEITC4Me campaign.

The campaign also researched other demographics of potential candidates for CalEITC help. Of households with incomes under $15,000 in targeted zip codes, 39 percent are Latino; 17 percent are African-American; and 11 percent are Asian. Only 16 percent of households are married and 48 percent are single without children; 35 percent have at least one child. Fifty-eight percent of people who make less than $15,000 are women. Ninety-one percent worked less than full-time. One in six moved in the last year and more than three-quarters are renters.

Nearby neighborhoods have thousands of filers that are eligible for the state credit and tens of thousands eligible for the federal. Broken down by ZIP code, the estimated number of filers eligible for state and federal credits look like this according to research done by the CalEITC4Me Campaign:

92103 – 300 to 399 for CalEITC; 1,343 (8 percent) for federal

92104 – 800 to 899 for CalEITC; 3,719 (17 percent) for federal

92105 – more than 2,000 for CalEITC; 9,792 (38 percent) for federal

92115 – 1,200 to 1,499 for CalEITC; 5,516 (25 percent) for federal

92116 – 500 to 599 for CalEITC; 2,277 (14 percent) for federal

For a more detailed examination of where potential EITC filers live, visit the CalEITC4Me Campaign’s heat map at caleitc4me.org/caleitc-heatmap.

For low- to moderate-income individuals or families who cannot prepare their own tax returns, the Volunteer Income Tax Assistance (VITA) program offers free tax help from qualified tax professionals.

“Sixty percent of Californians who were eligible for free tax assistance ended up paying to file their taxes at an average of cost of $200,” Martinez said. “That’s money families could have for food, transportation and other every day needs.”

According to the IRS, VITA generally helps people who make less than $53,000 annually, people with disabilities, the elderly, and people with limited English. All volunteers are IRS-certified and provide basic income tax preparation and help with electronic filing.

Other requirements for VITA eligibility are:

- You must have a valid Social Security Number (SSN)

• You cannot file separately if you are married

• You must have been a U.S. citizen or resident alien all year

• You cannot file Form 2555 or Form 2555-EZ

• Your investment income must be $3,400 or less

• You must have earned income. If you have a qualified child, you must meet the relationship, age, residency, and joint return tests

• Qualifying children cannot be used by more than one person to claim the EITC - If you do not have a qualifying child you: must be at least age 25 but under age 65; cannot be the dependent of another person; cannot be the qualifying child of another person; and must have lived in the U.S. more than half of the year.

For those whose incomes qualify for VITA, reserving a spot online is recommended. Each VITA location will have its own website or phone number where reservations can be made. If you are unable to reserve a time, walk-ins are welcome but times vary at each site.

Filers must also bring the following to the VITA appointment:

- Proof of identification – picture ID

• Social Security Cards for you, your spouse and dependents, or a Social Security Number (SSN) verification letter issued by the Social Security Administration or Individual Taxpayer Identification Number (ITIN) assignment letter for you, your spouse and dependents

• Proof of foreign status, if applying for an ITIN

• Birth dates for you, your spouse and dependents on the tax return

• Wage and earning statement(s) Form W-2, W-2G, 1099-R, 1099-Misc from all employers

• Interest and dividend statements from banks (Forms 1099)

• A copy of last year’s federal and state returns, if available

• Proof of bank account routing numbers and account numbers for direct deposit, such as a blank check

• Total paid to a daycare provider and the provider’s tax identifying number (their SSN or the provider’s business Employer Identification Number)

• Forms 1095-A, B or C, affordable health care statements

• To file taxes electronically on a married-filing-joint tax return, both spouses must be present to sign the required forms

Local VITA locations

Price Charities

- Home Start — 4305 University Ave., 92105

- Visit bit.ly/1Qny4gDor call 619-283-3624 for appointments and information.

- Walk-ins: Monday, 5 – 8 p.m.; Wednesday and Friday, 4 – 8 p.m.; Saturday, 9 a.m. – 2 p.m.

Comité Internacional de Rescate

- 5348 University Ave. Suite 205, 92105

- Visita bit.ly/1Qny4gD or call 619-7510 ext. 301 for appointments and information

- Walk-ins: Monday, Wednesday and Friday, 10 a.m. – 3 p.m.; Tuesday and Thursday, 1 – 6 p.m.; Saturday and Sunday, 10 a.m. – 3 p.m. (appointments available)

- Languages: English, Spanish, Somali, Cantonese, Mandarin and Vietnamese

Alliance for African Assistance

- 5952 El Cajon Blvd.

- Visita bit.ly/1Qny4gDor call 619-286-90452 for appointments and information

- Walk-ins (through April 13): Monday and Wednesdays, 3 – 6 p.m.

- Languages: English, Spanish, Arabic, Farsi

For a complete list of VITA sites throughout San Diego County, use the Tax Prep Finder Tool at bit.ly/1IPXq3W.

–Write to Jeff Clemetson at [email protected].